Win Rate

In the thrilling and often tumultuous world of trading, the Win Rate is your success scorecard. It’s the percentage of trades that end up in the green, or in simpler terms, how often you come out on top. Think of it as your batting average in baseball or your shooting percentage in basketball. The higher your win rate, the more frequently you’re hitting those profitable trades.

In this business, if you're good, you're right six times out of ten. You're never going to be right nine times out of ten.

- Peter Lynch

How to Calculate Win Rate?

Calculating your win rate is straightforward and crucial for evaluating your trading performance. Here’s the formula:

For instance, if you made 100 trades in a month and 60 of them were winners, your win rate would be:

This means that 60% of your trades were profitable.

Importance of Win Rate in Trading

The win rate plays a critical role in trading by providing insights into the effectiveness of your strategy, enhancing confidence to stick to your trading plan, and guiding adjustments to risk management. A clear understanding of your win rate allows you to set realistic expectations and make informed decisions that align with your financial goals.

Win Rate Reflects the Long-Term: Evaluate your win rate over dozens or hundreds of trades, not a handful. Short-term results can be misleading.

Comprehensive Examples of Win Rate Analysis in Trading

These examples illustrate the practical application of win rate in trading, showcasing how it is calculated, analyzed over time, and compared across different strategies. Understanding the relationship between win rate and other metrics like the Risk-Reward Ratio can help traders optimize their approach. Dive into each scenario to see how win rate influences overall profitability and strategy effectiveness.

Calculating Win Rate for Monthly Trades

Let’s consider a trader who executes 100 trades in a month. Out of these trades, 60 are profitable, while 40 result in losses. The win rate can be calculated as follows:

This trader has a win rate of 60%, indicating that 60% of their trades are profitable.

Analyzing Win Rate with Risk-Reward Ratio

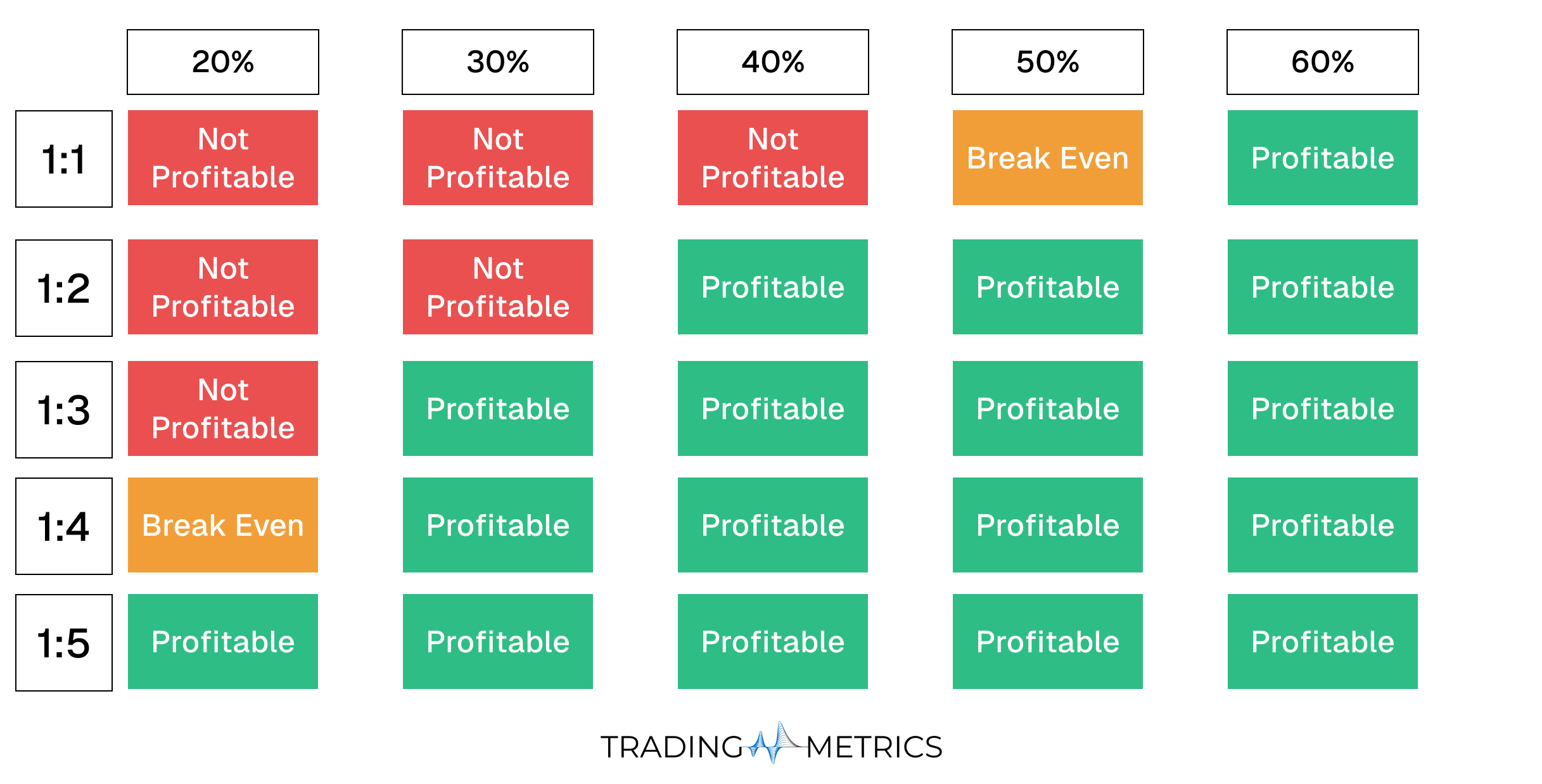

The table below shows how many wins and losses you need out of 10 trades at different Risk-Reward Ratios to be profitable.

We assume you risk $100 per trade.

| Risk-Reward Ratio | Win Rate Needed | Wins (Count) | Losses (Count) | Win Calculation | Loss Calculation | Net Result |

|---|---|---|---|---|---|---|

1:1 | 50% | 5 | 5 | 5 × +$100 = +$500 | 5 × -$100 = -$500 | Break Even ($0) |

1:2 | 40% | 4 | 6 | 4 × +$200 = +$800 | 6 × -$100 = -$600 | +$200 Profit |

1:3 | 30% | 3 | 7 | 3 × +$300 = +$900 | 7 × -$100 = -$700 | +$200 Profit |

1:4 | 25% (≈3 wins) | 3 | 7 | 3 × +$400 = +$1,200 | 7 × -$100 = -$700 | +$500 Profit |

1:5 | 20% | 2 | 8 | 2 × +$500 = +$1,000 | 8 × -$100 = -$800 | +$200 Profit |

⚠️ Important Note

- Risk is fixed at $100 per trade.

- A loss = - $100.

- A win = the reward side of the ratio (e.g., 1:3 = + $300 per win).

- At 1:4, the exact break-even is 2.5 wins out of 10 trades (25%). Since you can’t win half a trade, 2 wins loses money, 3 wins is profitable.

Key Takeaways

- At 1:1, you need 5 out of 10 wins to break even.

- At 1:2, you only need 4 wins to profit.

- At 1:3, just 3 wins are enough.

- At 1:4, 3 wins give a strong profit.

- At 1:5, even 2 wins out of 10 trades makes you money.

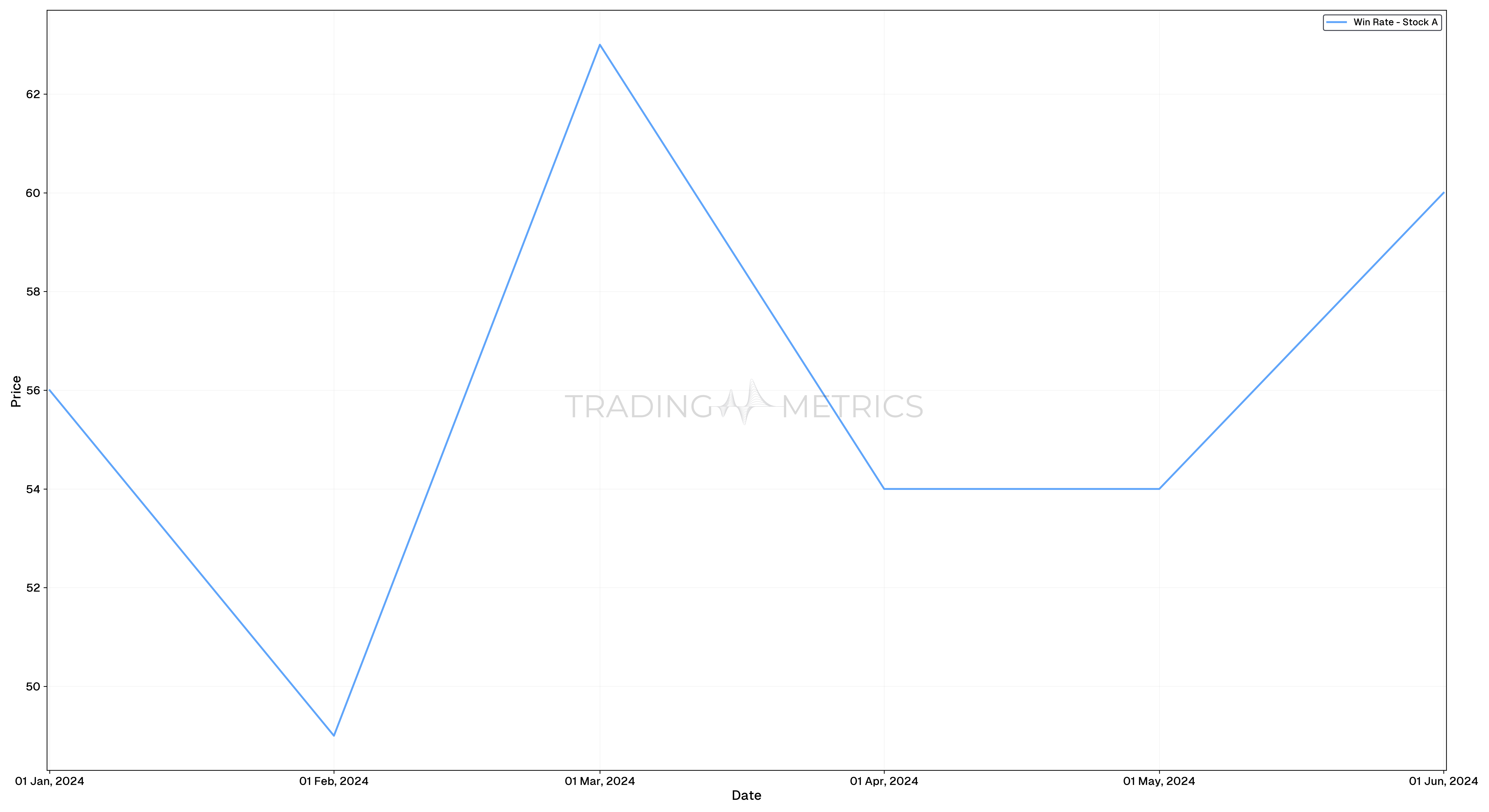

Win Rate Over Time

Tracking win rate over time can reveal trends and improvements in trading strategies. Let’s visualize the win rate over six months for a trader using the following data:

| Month | Total Trades | Winning Trades | Win Rate (%) |

|---|---|---|---|

January | 50 | 28 | 56% |

February | 45 | 22 | 49% |

March | 60 | 38 | 63% |

April | 55 | 30 | 54% |

May | 65 | 35 | 54% |

June | 70 | 42 | 60% |

Analyze for Quality, Not Just Quantity: A strategy with a 60% win rate but small losses and big wins may outperform one with 80% that risks too much.

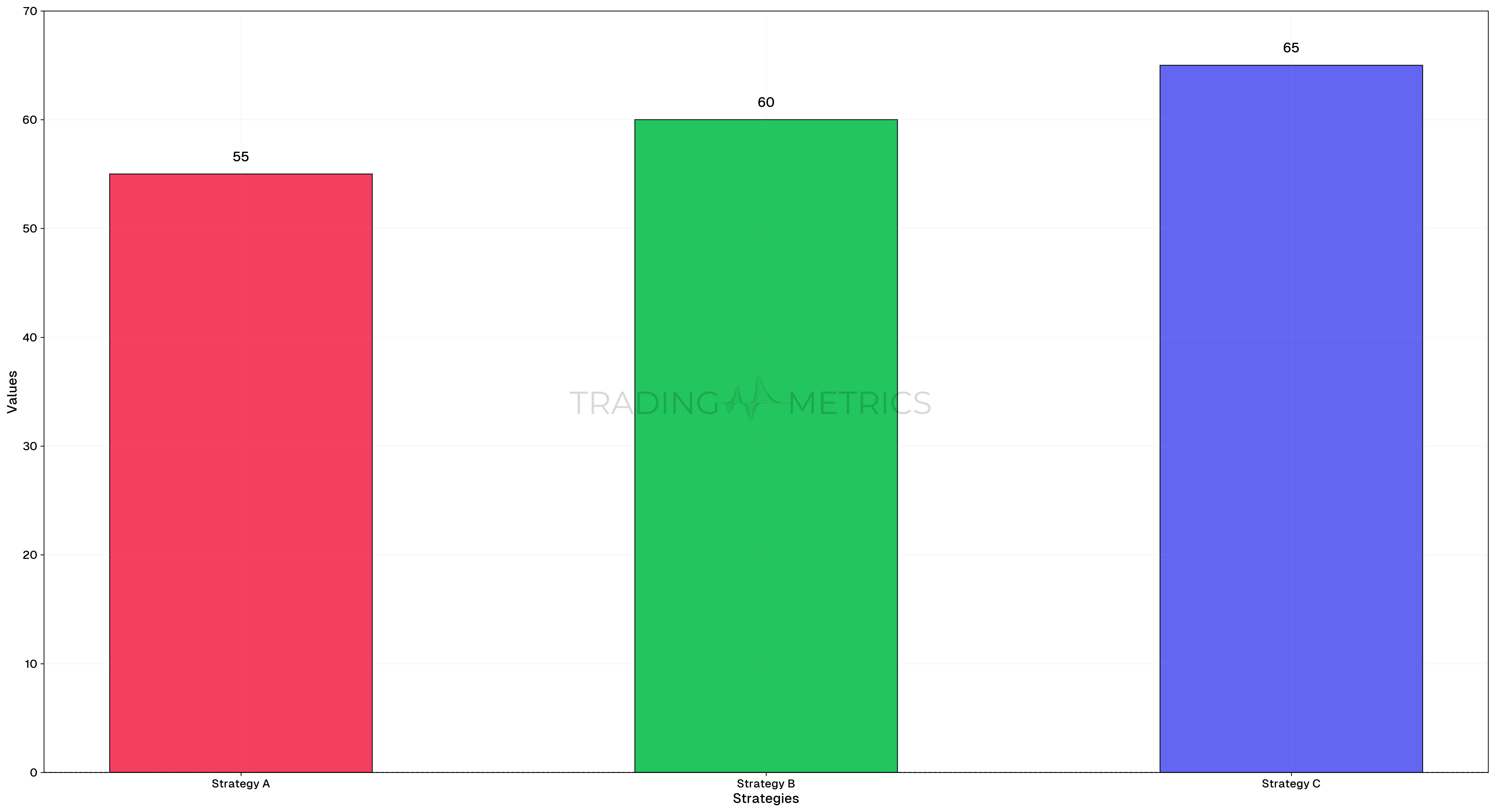

Comparing Win Rates Across Different Strategies

Comparing the win rates of different trading strategies can help in selecting the most effective one. Suppose we have three strategies with the following win rates over a series of trades:

| Strategy | Total Trades | Winning Trades | Win Rate (%) |

|---|---|---|---|

Strategy A | 100 | 55 | 55% |

Strategy B | 100 | 60 | 60% |

Strategy C | 100 | 65 | 65% |

Strategy A: Win Rate of 55%

-

Performance: Out of 100 trades, 55 are profitable.

-

Implication: While this strategy has a slightly better-than-average win rate, its profitability heavily depends on the Risk-Reward Ratio. If the strategy involves taking higher risks for higher rewards, it could still be very profitable despite a win rate close to 50%.

Strategy B: Win Rate of 60%

-

Performance: Out of 100 trades, 60 are profitable.

-

Implication: With a win rate of 60%, this strategy is more consistent in generating profitable trades compared to Strategy A. The higher win rate suggests a better success rate, making it more reliable. However, the actual profitability will still depend on the average profit per trade versus the average loss per trade.

Strategy C: Win Rate of 65%

-

Performance: Out of 100 trades, 65 are profitable.

-

Implication: Strategy C has the highest win rate among the three, indicating the highest consistency in profitable trades. A win rate of 65% suggests a robust strategy, assuming the Risk-Reward Ratio is balanced. This strategy is likely to be the most profitable if the average profit per trade does not significantly lag behind the average loss per trade.

Don’t Sacrifice Risk Management: Chasing a higher win rate often leads to poor risk management. Protect your capital first.

Combining Win Rate with Other Tools

To get a comprehensive view of your trading performance, combine win rate with these key metrics:

- Risk/Reward Ratio: The Risk/Reward Ratio compares the potential profit of a trade to the potential loss. It helps ensure that your wins are significantly larger than your losses.

- Profit Factor: Profit Factor is the ratio of total profit to total loss. It measures the overall profitability of your trading strategy.

- Average Win and Average Loss: These metrics provide insights into the typical size of your winning and losing trades.

- Max Drawdown: Maximum Drawdown measures the largest peak-to-trough decline in your portfolio. It helps you understand the potential risk and worst-case scenario for your strategy.

Track, Learn, and Refine: Keep a trading journal to monitor win rates, identify patterns, and refine your strategy for better outcomes.

Key Points

- Measure of Success: Win rate calculates the percentage of profitable trades or investments out of total trades, serving as a straightforward success metric.

- Not the Whole Picture: A high win rate does not guarantee profitability; it must be analyzed alongside Risk-Reward Ratio and average trade size.

- Impact on Strategy: Strategies with lower win rates can still be highly profitable if they maintain favorable Risk-Reward Ratio.

- Context-Specific: The ideal win rate varies depending on the trading style as scalpers may prioritize higher win rates, while trend-followers may accept lower rates with larger profits per trade.

- Consistency Indicator: A stable win rate over time reflects disciplined execution and adherence to a trading plan.

- Psychological Impact: A high win rate can boost trader confidence, but an overemphasis on it may lead to ignoring risk management.

- Adaptability: Regularly monitor the win rate to identify changes in market conditions or strategy effectiveness that may require adjustments.

- Benchmarking Performance: Use win rate as a comparative tool to evaluate the success of different strategies or traders within the same market.

- Complementary Metric: Combine win rate with metrics like expectancy and Profit Factor for a complete assessment of trading performance.

- Scalability Insight: A high win rate strategy might not scale effectively to larger positions, requiring careful evaluation of liquidity and execution factors.

Conclusion

The Win Rate is very important metric in the fast-paced world of trading, giving you a snapshot of how often you’re successful. However, it’s not the only measure of success. A high win rate combined with a favorable Risk-Reward Ratio, strong Profit Factor, manageable drawdowns, and consistent Average Wins paints a comprehensive picture of a successful trading strategy.